March 1, 2021

Why is it that the wealthiest country on earth has the highest death toll of any nation in the world? And why are Black and Latino people among those experiencing the greatest mortality and hardship during the pandemic?

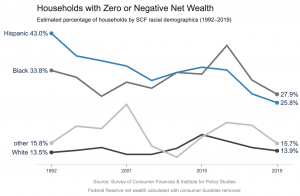

There is excellent research on how the Black-white wealth gap left Black households more vulnerable (see resources below). But let’s consider the racial wealth divide in financial reserves as measure of precariousness as the U.S. entered into the pandemic. A much higher percentage of Black and Latino households are part of the vulnerable “underwater nation,” with zero or negative wealth.

According to the most recent Federal Reserve data, 14 percent of white households had zero or negative wealth. An estimated 28 percent of Black households had zero or negative wealth, twice the level of whites. And 26 percent of Latino households had zero or negative wealth.

This is a slight improvement over previous years. Emerging from the 2008-2009 economic meltdown, 40 percent of Black households and 34 percent of Latino households had zero or negative wealth in 2013, compared to 16 percent of white households.

By one estimate, from before the pandemic, almost 80 percent of U.S. workers live paycheck to paycheck. Miss one check and you’re taking a second look at what’s in the back of the pantry cupboard.

There is a strong likelihood is that the pandemic will exhaust the financial savings and reserves of many households and we can anticipate an increase in the number of households in “underwater nation.”

Notes: Our analysis draws from 2019 Federal Reserve data and excludes cars from the calculation of wealth. Our view is that car ownership is an insufficient indicator of financial well-being and essentially illiquid as a form of wealth. For more on methodology, go HERE. Thanks to Joe Fitzgerald for his assistance with this research.