Of all the products made at Danette Wilder’s small manufacturing plant near the University of Kentucky in Lexington, the products she depended on most for sales were the O-rings cranked out by her vintage presses.

Each month, Wilder’s crew of six people, working at long tables as they listened to a soundtrack of funk and R&B, made thousands of the rubber loops, cut from spools into precise strips and spliced into uniform perfect circles.

The work distinguished Wilder’s company, SealingLife Technology, as one of the vanishingly few rubber products suppliers owned by a female engineer — not to mention one who is also Black. It hasn’t been an easy path: Wilder has navigated state and federal set-aside programs, tight-fisted bankers and what she saw as obvious discrimination. But eventually, Wilder built SealingLife into a reliable vendor for all manner of aerospace, medical and other industrial businesses.

Now, SealingLife is struggling to survive as orders for its O-rings have dried up over the past year, plunging the company into hundreds of thousands of dollars in debt. That’s not an unusual story in the current pandemic-induced recession, which has been a gut punch for millions of small business owners. But Wilder faces obstacles that are disproportionately common among Black-owned companies, which on average had fewer resources to draw upon going into last year, were hit particularly hard by the downturn and were less well-served by the relief programs set up to help.

Danette Wilder in Lexington.

(Andrew Cenci for ProPublica)

Danette Wilder in Lexington.

(Andrew Cenci for ProPublica)

“We’re in a purgatory state,” Wilder said. “The long term is, if we can’t get our foot in the door with people who understand what we do and how we do it and provide us opportunities to grow, then the outcome is very bleak.’’

There are disparities between American businesses owned by white people and those owned by all minority groups, but the widest ones are typically with Black entrepreneurs, who tend to have modest family wealth and thin professional networks to help recruit talent and cut deals. Although the number of Black-owned businesses has grown in recent years, the vast majority remain sole proprietorships. As of 2012 — the most recent data the Census Bureau has collected — average annual sales for a Black-owned business came to about $58,000, compared to nearly 10 times that amount for the average white-owned enterprise.

Those years of compounding disadvantage have been exacerbated by the pandemic. For example, 18.4% fewer self-employed Black people were working in July 2020 than there had been a year previously, compared to 6.2% fewer self-employed white people (the dips for Asian and Hispanic people were even smaller). And minority-owned businesses overall have also been at the back of the line for relief programs, which were initially designed without factoring in the unique challenges of small businesses owned by people of color. As a result, federal Paycheck Protection Program loans to businesses in areas with a higher percentage of minority residents came in later and in lesser amounts per employee.

White-Owned Firms Are More Likely to Meet Criteria for Health and Stability

Note: Healthy firms meet at least two of these criteria: Profitable, high credit score, or use retained business earnings to fund firm.

(Source: [U.S. Federal Reserve Bank of New York](https://www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2020/DoubleJeopardy_COVID19andBlackOwnedBusinesses))

Note: Healthy firms meet at least two of these criteria: Profitable, high credit score, or use retained business earnings to fund firm.

(Source: [U.S. Federal Reserve Bank of New York](https://www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2020/DoubleJeopardy_COVID19andBlackOwnedBusinesses))

That’s not new either. Decades of public and private initiatives meant to boost minority-owned businesses have fallen short. Since the 1980s, race-based contracting preferences have been weakened by federal court rulings. Now, the pandemic’s fallout threatens to arrest the nascent progress of a generation of Black entrepreneurs. That would only widen the yawning gap between wealth held by white people and that held by African Americans, which had barely begun to narrow after the last recession in 2009.

Wilder, 50, stands an imposing 6 feet tall, and shows up for a factory tour wearing maroon slacks, loafers, and big blocky glasses. She’s lived through all of those systemic disadvantages that show up in statistics. But she doesn't want to end up like the averages. She just wants a fair shake.

“Whenever something’s been amputated, you need a recovery period,” Wilder said. “It’s sort of like, when you get behind on something, if there's nothing to help you recover, nothing really helps.”

Danette Wilder grew up in inner-city Detroit, where her father, with only a few years of formal schooling, had moved to work in a Chrysler plant. She went to Detroit’s Central High School, which at the time had one of the worst graduation rates in the nation.

But Wilder did well in school, and enrolled at Old Dominion University, in Norfolk, Virginia, where her half-sister Gwendolyn Wilder lived. When their brother was murdered in Detroit, the two sisters took over caring for his two infant children. Danette Wilder worked multiple research and development jobs while finishing her degree, then landed an engineering job at Corning Inc., the venerable materials company now famous for making glass iPhone screens. Gwendolyn Wilder, too, got a Corning job, as an executive assistant.

Corning, located in largely white upstate New York, was making a diversity push. But Danette Wilder said she soon learned that she’d been hired at a much lower salary than the other engineering recruits; when she raised the disparity with her bosses, she said, she got nowhere.

Instead, Wilder tried a workaround, getting a side job for a few hours a week at a Toys R Us in Corning, which she knew company employees and executives would frequent. The extra income helped, but she also believes her second job led higher-ups to double her pay. “It caused such an uproar, because people were like, ‘She works for Corning?’” Wilder recalled.

Wilder believes SealingLife Technology is one of the few Black-owned rubber companies in the U.S.

Andrew Cenci for ProPublica

Wilder believes SealingLife Technology is one of the few Black-owned rubber companies in the U.S.

Andrew Cenci for ProPublica

Wilder reasoned that working within the system might be more effective than loudly decrying injustice. “Sometimes it’s not all about starting a riot,” she said. “It’s about strategically understanding their rules, and learning how to utilize them to get what you need.” (A spokesperson for Corning declined to comment on the incident but said that the company has “consistently operated at parity for minority and majority pay equity for many years.”)

Next, Wilder joined Toyota Motor Manufacturing in Georgetown, Kentucky, which paid even better. But the work wasn’t as professionally stimulating as at Corning, so Wilder started doing some information technology consulting on the side, and in 2005 she quit Toyota to go out on her own. One consulting client was Les Burd, who in 1989 had started a rubber company called ElastoSeal. Burd hired Wilder as ElastoSeal’s chief operating officer, and credits her with improving all manner of business functions. A few years later, when Burd was looking for a succession plan, they arranged for Wilder to buy a stake in the company.

The transfer, however, hit a snag when other people involved in the transaction objected. That brought Wilder to a familiar point for many people of color: Seeing no other plausible explanation for a setback, and wondering whether discrimination could be at play. “You see I’m educated. I’ve proven I know how to make you money. And you’re still struggling?” Wilder said. “It’s hard to prove in a court of law, but it really is that legitimate.”

Burd said he understands prejudice exists, but doubts that it thwarted his deal with Wilder (who emphasized her respect for him). “It’s just different hurdles to jump through, and we didn’t make a conscientious enough effort to get it done,” he said.

While the deal languished, Wilder started SealingLife, focusing on niche, high-value, low-volume products, many of which needed to be custom-designed to fit specific machines. ElastoSeal eventually leased part of its facility to Wilder and allowed her to run most of its operations. Wilder figures the long incubation period within an established business may have helped her gain a foothold in Kentucky’s decidedly white male manufacturing industry. (According to the Census Bureau, in 2012, 6,269 out of 7,032 manufacturing firms in Kentucky were white-owned, while 122 were owned by Black people.)

“We gained a lot of business under that camouflage, because it was white-owned,” Wilder said of assuming ElastoSeal’s operations. Gwendolyn Wilder, who now helps run SealingLife, recalled both of them being blatantly slighted in meetings with other businesses and lenders. “It’s not like it’s hidden. It’s in your face,” she said.

Wilder with her brother Delonzo Wilder, left, and half-sister Gwendolyn Wilder.

(Andrew Cenci for ProPublica)

Wilder with her brother Delonzo Wilder, left, and half-sister Gwendolyn Wilder.

(Andrew Cenci for ProPublica)

Danette Wilder’s small staff includes her brother Delonzo Wilder, who helps with SealingLife’s trucking division, and childhood friend Jasmine Heflin, who works in the production room. As orders dropped off during the pandemic, Wilder tried to avoid layoffs by reducing hours, which was easier because some employees left of their own accord to care for children whose schools had closed.

Inside the company’s supply warehouse, a high-ceilinged room with racks that hold spools of rubber and plastics, a curtained-off section hides much of the advanced work that may be key to SealingLife’s future. Sitting atop a giant tabletop machine used to cut large sheets of material, Wilder huddled with a young process engineer named Sarah Honchul, who showed her a tiny, orange, hole-filled rubber rectangle that she had developed for an equine medical device. (Kentucky is horse country, after all.) Honchul is also working on a gasket seal for a company that manufactures laboratory experiment systems for the International Space Station.

“That has to pass tests at NASA,” Wilder said with a hint of pride.

SealingLife is AS9100- and ISO 9001-certified, which allows it to do aerospace business. The certifications are neither easy nor cheap to get, but they are supposed to pay off by getting big companies to trust a business to deliver quality on high-risk products. SealingLife will do lower-tech jobs too; one of its more consistent gigs is making football thigh pads with custom-designed decorative imprints.

Still, everything is harder for companies without strong networks and vast capital reserves. Wilder doesn’t have the cash flow to afford high salaries, so she hires workers right out of college and trains them. She can’t afford new equipment for extruding and grinding rubber, so she buys ancient machines at auctions and refurbishes them. The colorful masses of steel sit like dinosaurs around the warehouse, in various states of operability. “The newest thing in here is probably the fridge,” said Jennifer Cady, Wilder’s quality representative.

When the machines break, which they often do, Wilder repairs them herself, sapping time from hunting new business. She could seek a loan to expand more quickly, but Black-owned firms have historically had a tougher time with lenders. According to a 2016 Federal Reserve survey, the share of Black entrepreneurs applying for loans was 10 percentage points higher than that of white entrepreneurs — but were almost twice as likely to have their applications rejected.

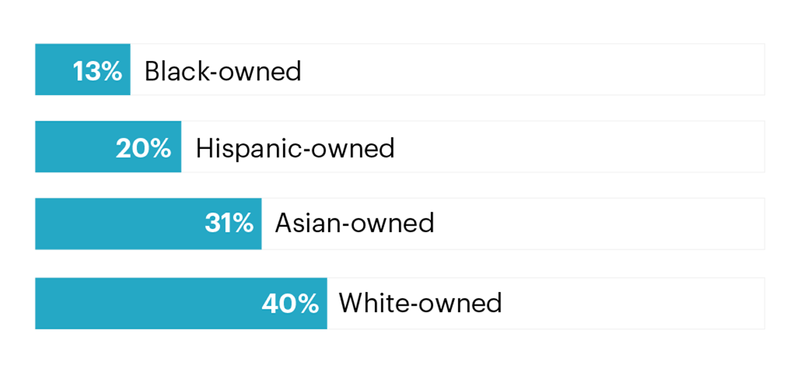

Black-Owned Firms Are Less Likely to Receive All of the Financing They Apply for Than Firms With Non-Black Owners

Only 13% of Black-owned firms that applied for loans received all of the financing they sought.

Note: Black, Asian and white categories refer to non-Hispanic owners.

(Source: [U.S. Federal Reserve System](https://www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2021/2021-sbcs-employer-firms-report) survey from September and October 2020.)

Note: Black, Asian and white categories refer to non-Hispanic owners.

(Source: [U.S. Federal Reserve System](https://www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2021/2021-sbcs-employer-firms-report) survey from September and October 2020.)

Burd, who is white, said he never had trouble getting loans for ElastoSeal. Wilder’s experience was different: Her own bank turned her down for a loan multiple times, and she finally found a small local bank to extend credit. Of course, it’s easier to guarantee loans with high-dollar, long-term contracts in place. And those kinds of contracts are difficult to win without equipment that produces quick turnarounds.

For example, cutting rubber for O-rings takes longer than it would if SealingLife had the capital to purchase more modern equipment. The company’s hand presses are difficult for less-skilled workers to operate, making it harder to ensure high-quality product. “We would love to get automated presses, because that makes it so we can standardize the process more, we’d have more consistent pieces coming out,” Cady said.

An old machine needing repair at SealingLife’s plant.

(Andrew Cenci for ProPublica)

An old machine needing repair at SealingLife’s plant.

(Andrew Cenci for ProPublica)

To help her employees develop some of those skills, Wilder sent them to train with Darryl Hawkins, who runs a small rubber compounding company in Wichita Falls, Texas. Compounding involves mixing various chemicals used in rubber production, such as carbon black, which can coat clothes and skin so thoroughly that it still seeps onto sheets after workers have taken a shower. Hawkins and Wilder met at a conference; as far as they can tell, theirs are among a small handful of Black-owned rubber companies in the U.S.

Hawkins followed a path similar to Wilder’s, but two decades earlier. He served as a chemist for tire manufacturing companies before striking out on his own in 1985. Trying to get loans, he said, he was often passed over. Instead, he slowly expanded his company. He primarily served the oil industry, which was struggling with sagging prices before the pandemic, and saw them fall off a cliff when energy demand collapsed. He would sell his business, but there aren’t many interested buyers.

“Unfortunately, it’s like trying to reach up like a drowning man right now,” said Hawkins, who has a fuzzy beard and walks with a cane. “You’d grab for almost anything.”

Wilder hoped that her orders for rubber would keep his business alive, but hasn’t had enough to pass along. She still dreams of buying Hawkins out, but the pandemic put a hitch in those aspirations. Now, she worries about becoming what he is: a small business owner without a cushion that could be wiped out if conditions worsen.

“Where is his retirement?” Wilder asked, rhetorically. “I get emotional about this now. Because there are still people out here who have a sense of integrity, want to give back and do well and serve their customers the old-fashioned way. A lot of minority companies, that’s what they want to do.”

And despite all the progress America is supposed to have made on racial equity, nothing seems to be getting easier.

“I see it happening to me,” Wilder said.

A work station at the plant.

(Andrew Cenci for ProPublica)

A work station at the plant.

(Andrew Cenci for ProPublica)

Policymakers have tried for years to mitigate the structural disadvantages facing minority-owned businesses, but those efforts have been scaled back over the years, rather than strengthened.

Take contracting preferences. After passage of a 1977 law, federal, state and local governments set firm targets for the percentage of their procurement dollars that should go to minority-owned businesses. White business owners challenged them almost immediately in court. In 1989, the U.S. Supreme Court overruled a set-aside program in Richmond, Virginia, but left the door open if the public entity conducted a study and found that minority-owned firms were disadvantaged in the area. In 1997, even that bit of flexibility disappeared, when the high court found that Philadelphia’s set-aside program was unconstitutional. Over the years, cities and states weakened their minority contracting requirements to the point where they often have little effect.

In Lexington, for example, the city government aims to award 10% of its contracting dollars to disadvantaged businesses. But that category includes women- and veteran-owned businesses, which scooped up the overwhelming majority of those opportunities in 2019 and 2020, according to the Lexington Herald-Leader. Less than 1% of the dollar value of the city’s disadvantaged-business contracts went to Black-owned businesses.

Wilder’s experience with city government contracting has been difficult. In 2014, she decided to repurpose trucks that she’d purchased for rubber business and turn them instead into a waste-hauling division. As the business grew, she signed on as a minority-owned subcontractor to a white-owned company called Waste Services of the Bluegrass, which was vying for Lexington’s 5-year, $17 million trash contract. She thinks her participation in the bid helped Waste Services ultimately win. But as the number of vehicles needed to fulfill the contract grew beyond Waste Services’ plans, she contends, her equipment was damaged and the business went to another supplier. She's now suing in Fayette County Circuit Court for breach of contract, having lost thousands of dollars on the debacle. Waste Services did not respond to a request for comment.

“Welcome to Kentucky,” Wilder said wryly.

On the state level, Kentucky maintains a directory of women- and minority-owned businesses, but does not require their participation in government procurement.

A few of SealingLife’s high-value finished rubber products.

(Andrew Cenci for ProPublica)

A few of SealingLife’s high-value finished rubber products.

(Andrew Cenci for ProPublica)

Federal programs have also been under attack. For example, in 1998, U.S. Sen. Mitch McConnell tried to amend a transportation funding bill to strip out race-based preferences. “Every time the government hands out a highway contract to one person based on race or gender, it discriminates against another person based on race or gender,” McConnell said during floor debate. The Department of Transportation’s disadvantaged business contracting program survived, but the Clinton administration had already tightened eligibility requirements, making it harder to qualify.

What’s left is the Small Business Administration’s 8(a) program, which gives a competitive edge for federal contracts to small firms that are owned by veterans, minorities, or women. But with onerous certification requirements and no guaranteed returns, the number of enrolled businesses sank in the early 2010s. Participation rose again over the past few years as the application process was streamlined. In 2018, the agency’s inspector general criticized the changes for giving benefits to firms that weren’t truly disadvantaged. (Hawkins’ business got certified — at a cost of about $10,000 — but he said he never saw much new business as a result. Wilder is in the process of applying, saying she thinks she’s built the connections necessary to actually win contracts.)

The federal government also tries to help minority-owned businesses in other ways. The Minority Business Development Agency, established by presidential decree in 1969, has limped along with a budget of about $45 million a year, running a network of business assistance centers and commissioning occasional research reports.

President Donald Trump proposed eliminating the MBDA, but Congress did not oblige. So to run the office, Trump appointed a 2016 campaign volunteer who, before he took a job in Trump’s Department of Commerce, had no business development experience: Henry Childs II, a Texas lawyer.

Childs said he tried to get the MBDA enshrined in statute, and despite his initial allegiance to Trump, spoke up when he saw potential problems with White House initiatives like PPP that gave an edge to businesses with strong banking relationships. “I don’t know if they thought the PPP was going to be the answer, but it wasn’t,” said Childs, who went on to launch a private equity fund for minority-owned businesses. “I don’t think they understand the difference between Wall Street and Main Street.”

Efforts to help minority-owned businesses also exist in the private sector. Over the years, many large companies have developed “supplier diversity” programs to include entrepreneurs of color. But they often have little transparency and weak standards, according to surveys.

With heightened attention to racial injustice following the George Floyd police killing, many large corporations pledged to amp up supplier diversity and lending initiatives. Coca-Cola, for example, pledged to increase its purchases from Black-owned suppliers by $500 million over the next five years, while Netflix deposited $100 million into Black-owned banks. But Adrienne Trimble, who ran the National Minority Supplier Development Council until Mar. 1, when she took a job as chief diversity officer at Sysco, worries that corporate attention could fade.

“We don’t want this to just be a moment in time,” Trimble said. “We expect this to be a movement, and holding those companies accountable to ensuring they have diversity in their supply chains.”

An employee cuts rubber to make O-rings at SealingLife.

(Andrew Cenci for ProPublica)

An employee cuts rubber to make O-rings at SealingLife.

(Andrew Cenci for ProPublica)

Accountability is an elusive thing. Outside of government contracting, no law requires private businesses to contract with minority-owned firms, or to disclose how much they do. As Wilder has experienced, a diversity initiative can peter out quickly. “Like a lot of things to help women and minorities, there’s a big push for a while, and then it wanes off,” Wilder said, remembering her time at Corning.

Parker Hannifin, the Cleveland-based conglomerate, was SealingLife’s biggest O-ring customer until it cut back its orders almost to zero in early 2020. Wilder said the company gave her no explanation.

A spokesperson for Parker Hannifin, Aidan Gormley, said that orders were dropped after it merged several business units and began to manufacture O-rings in-house. “The change was a business decision and in no way reflected the quality of products or services provided by the supplier,” Gormley said.

Parker Hannifin said it has a diverse supplier base, but it declined to disclose any numbers, which makes Wilder skeptical about how much effort they’re putting into it. The company controls so much of the market for seals that, without it, Wilder has a more limited range of potential customers. Wilder even won a regional supplier of the year award from the NMSDC, which she hoped would jump-start new business opportunities. But pitching big companies is frustrating, even when they have supplier diversity programs.

“A lot of times the wrong people are sitting at that table, and they don’t have the knowledge to know what we’re talking about, and they don’t know where to put us,” Wilder said. “So we get caught in this nested loop, which becomes very frustrating, if 99 out of 100 times that’s what happens.”

Wilder is grateful for the nearly $500,000 she got from the SBA’s Economic Injury Disaster Loan and PPP programs, which she applied for early (although her second-draw PPP loan hasn’t come through yet, leaving her more dependent on the non-forgivable EIDL). But it’s merely left her treading water, while she works to diversify into operations consulting and team up with other small companies to go after bigger contracts.

What more could public policy do? Along with strengthening government contracting requirements for small businesses, Wilder suggests, one big step would be more heavily incentivizing and monitoring private-sector supplier diversity programs. If the federal government pushed companies like Parker Hannifin to buy goods and services from small and minority-owned firms, she thinks, the resulting leg up would allow companies like hers to grow and be more competitive.

Advocates and academics have proposed plenty of other ways to bolster Black entrepreneurs. One would be for the federal government to pump tens of billions of dollars into community development financial institutions, which explicitly focus on lending in underserved communities. (Congress got a start on this in December, allocating $12 billion to CDFIs.) Another would be re-invigorating the MBDA to fund more universal, easier-to-access technical assistance programs and to make infrastructure grants that support Black communities, like renovating and redistributing vacant properties. (Connor Maxwell, the Center for American Progress analyst who co-wrote the MBDA proposal, now works at Biden’s National Economic Council, but so far the administration’s racial equity agenda has not specifically focused on minority-owned businesses.)

One side benefit of supporting minority-owned businesses is that they tend to employ more people of color, which could also help close racial gaps in unemployment. And that’s true of Wilder. She’s always seen her business as a way to lift up those around her. Long-term, she doesn’t want SealingLife to be just a family business. She wants it to be something bigger.

“This industry has been run by a lot of white companies that do this and they pass it down to their kids, and it’s like a glass ceiling, and breaking into it is impossible,” Wilder said. And then, only half-joking: “The government needs to have a stimulus package for mental health counseling for what we go through, the constant letdowns. We need some rehab.”

Do you have access to information about economic injustice that should be public? Email Lydia DePillis at lydia.depillis@propublica.org. Here’s how to send tips and documents to ProPublica securely.